Investment Advisory, Strategy, and Management

Youxfort Family Office starts with understanding our clients' needs, investment goals, and financial situations. We integrate market investment principles and tax considerations to provide clients with professional, exclusive, and independent trading philosophies and investment advisory support. Utilizing product channels from globally renowned private banks, brokerages, and fund platforms, we select high-quality products to deliver comprehensive, customized, and suitable investment portfolios, helping clients achieve their investment objectives.

To achieve asset preservation and growth, we'll provide professional and scientific investment advice and asset management tailored to your needs, investment goals, and financial situation.

We take a goal-oriented approach, helping you define clear investment objectives based on your financial situation, risk tolerance, and investment horizon. Examples include retirement planning, children's education funds, and financial and real estate investments.

Based on your confirmed investment strategy, we execute an investment portfolio plan that aligns with it, including, for example, stock investments, bond investments, fund investments, and real estate investments.

Based on market fluctuations and your investment goals, we optimize and adjust your investment portfolio to enhance asset returns, mitigate investment risks, and achieve your investment objectives.

Based on your investment goals, risk tolerance, and changes in market conditions, we'll recommend suitable investment advice and strategies. This helps you seize investment opportunities, reduce investment risks, and navigate even the most complex situations.

Additionally, by understanding your comprehension and attitude towards your family's financial situation, as well as your willingness to manage it scientifically and reasonably, we offer professional family financial review services. These services help you analyze your financial standing. Based on information regarding your income, expenses, assets, and liabilities, we'll issue a "Family Financial Analysis Report" to assist you in formulating budget plans and providing recommendations for cash flow management.

Investment Products

Our investment products offer clients a comprehensive range of choices. Whether you're a conservative investor seeking stable returns or an aggressive investor aiming for high returns, we can provide you with tailored solutions.

By carefully selecting top-tier global funds, we achieve diversified market exposure and reduce risk. We curate 10-20 high-quality funds and offer a diverse selection of private equity funds and hedge funds.

Bonds offer relatively stable fixed income, making them suitable for conservative investors. Their prices are influenced by market interest rates and the issuer's ability to repay. Our offerings include global government bonds and highly-rated corporate bonds, among others.

We offer foreign exchange trading, principal-protected investment deposits, and currency-linked deposits. Based on foreign exchange trends, you can select various linked currency combinations to capture forex investment opportunities while also enjoying potential interest returns.

These offer flexibility and diversified choices, making them suitable for investors with specific goals. They include structured bonds, structured deposits, fixed-income notes, and enhanced participation notes, among others.

We identify the most promising industries globally and specific areas within primary market equity investment opportunities. We then select high-quality investment targets, aiming to realize investment gains through methods such as IPO (listing), mergers and acquisitions (M&A), and share repurchases. Our focus areas include, for example, high-end manufacturing.

These products offer 100% principal protection, making them suitable for investors seeking stable returns. They provide diversified risk exposure by combining assets such as equities, fixed income, and foreign exchange to ensure consistent performance. Examples include index-linked principal-protected notes, interest rate-linked principal-protected notes, and callable/puttable notes.

Through global equity allocation, we help clients reduce investment risk and ensure stable long-term returns. Our market coverage includes major markets such as North America and Asia-Pacific, enhancing the diversity and security of your investment portfolio.

External Asset Management (EAM Model)

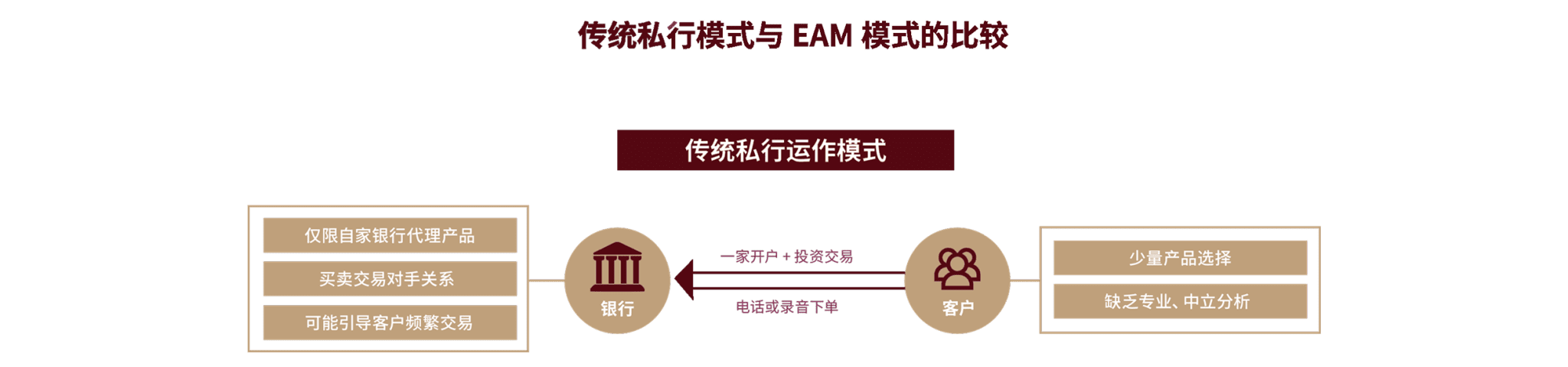

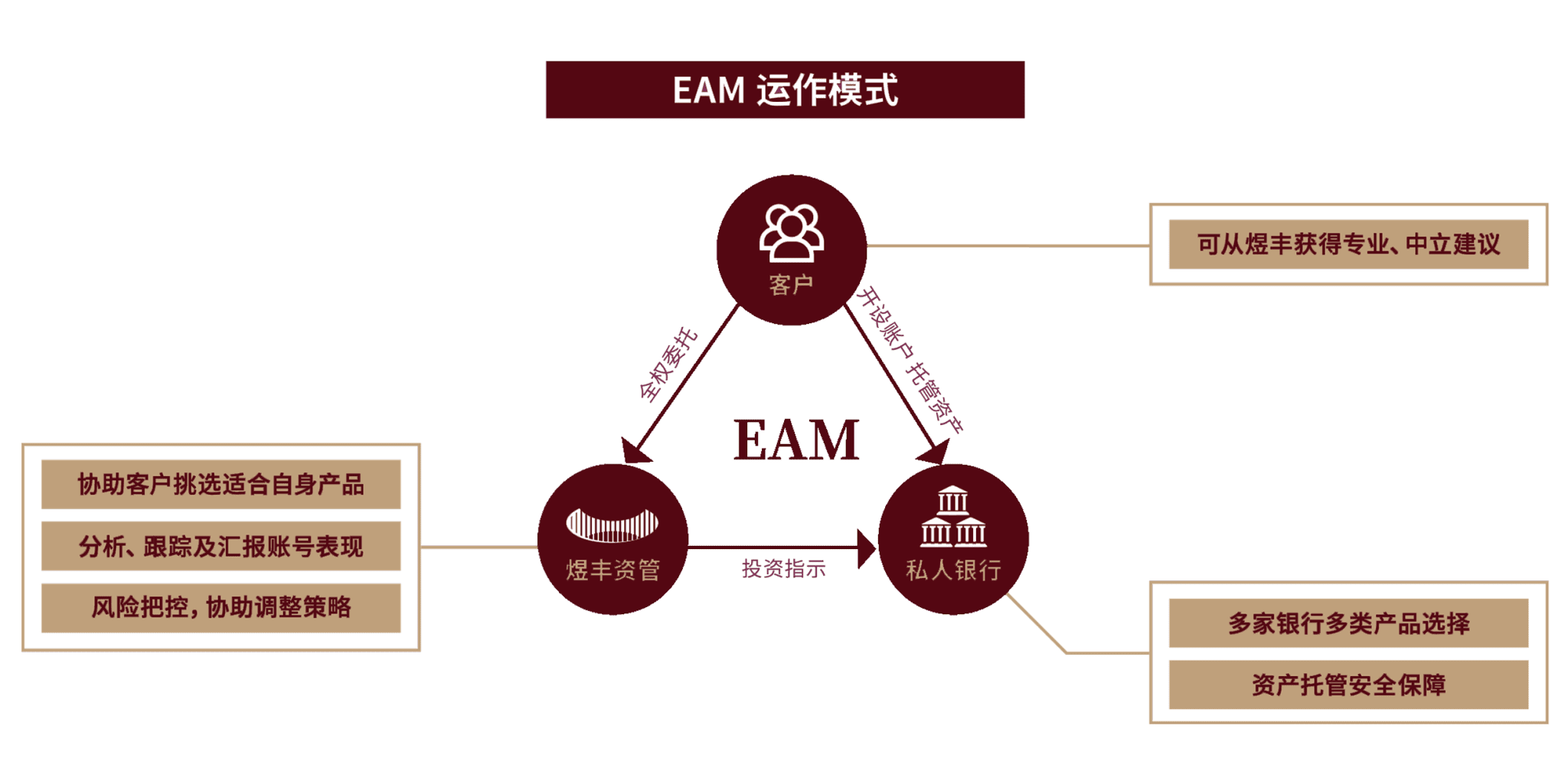

External Asset Managers (EAMs) act as third-party platforms, serving as intermediaries between private banks and clients. We hold licenses regulated by the Securities and Futures Commission (SFC) for asset management and advising on securities. Under this regulation, we assist clients in opening accounts with traditional private banks and brokerages.

After clients deposit assets into their accounts, they can grant the EAM authorization and a power of attorney. This allows the EAM to manage their investment portfolio and asset allocation on their behalf. The assets remain in the client's name within the account, with the private bank solely acting as the custodian and record-keeper; however, the EAM will assist the client in managing these assets.

Unlike traditional private banks, EAMs are independent third parties whose interests are aligned with those of their clients. EAMs don't have sales targets tied to profitability, so they aren't pressured to sell their own financial products. Instead, they objectively compare products from various private banks, brokerages, and fund platforms, recommending the most suitable service providers to clients. This allows EAMs to offer truly independent and objective investment advice and strategies, as well as discretionary investment services. This approach fosters sustainable growth and a shared long-term goal of asset appreciation.

Clients can customize assets across multiple countries and regions, including Hong Kong, Singapore, Switzerland/Liechtenstein, and the United States. This meets their need for independent asset custody in specific global locations, freeing them from the limitations of a single bank platform or product. This approach not only saves significant time and effort typically spent dealing with financial institutions but also enables more personalized and independent asset management services, all within a client-centric operational framework.

Advantages of EAM